Millions Recovered for Business Owners and Homeowners each year from hurricane claims!

OUR OFFER:

LOCAL | AGGRESSIVE | RELENTLESS REPRESENTATION

OUR MOTTO:

We don't just inform you of your rights under your insurance policy, we DEMAND THEM from your insurance company!

HOW IT WORKS:

We will review your claim for free and front all costs. If no new money is recovered, you are not responsible for our attorneys' fees or costs. We will aggressively and relentlessly maximize your recovery. We will strive for bad faith penalties the insurance company should pay on top of the funds needed to repair your property for the way the insurance company treated you. No one will fight harder for you! Let us handle your claim while you focus on recovering from a tragic loss.

GEAUX LOCAL

We are all career-long, south Louisiana attorneys who relentlessly fight for our clients. Be mindful of out of state attorneys who are not versed in our intricate civil code. Our laws are different than any other state in the country. Ensuring you have a local attorney to navigate our Napoleonic laws is crucial to maximizing your insurance claim recovery

We are constantly active in local Louisiana communities volunteering our time to make a difference. We are present and former board members for numerous organizations including, the Ground Force Humanitarian Aid (formerly Cajun Navy Ground Force), Terrebonne Bar Association, the Gordon “Bubba” Dove, Jr. Foundation, Houma Terrebonne Airport Commission, TFAE, Terrebonne Election Board of Supervisors, Project L.E.A.D., CASA, and examiners appointed by the Louisiana Supreme Court for the Committee on Bar Admission to name a few.

Hire a local, charitable law firm that has and will continue to give back to our communities. We have organized several food and donation giveaways and continue to raise and donate money to local citizens affected by hurricanes and floods.

We were actively handling hurricane claims before Hurricane Laura, Delta, Zeta, Ida and Francine and will be here for decades to come after. Don’t be fooled by a law firm who will be gone after their claims dry up. Together we will fight. Together we will rebuild. We are Louisiana United!

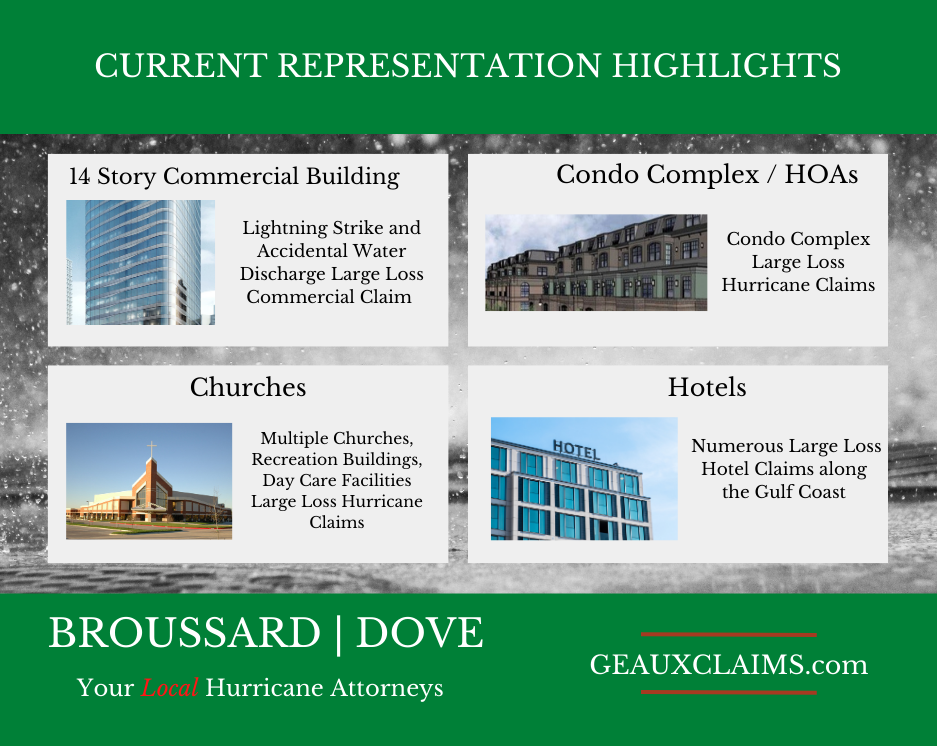

GEAUX WITH EXPERIENCE

The aftermath of a disaster can push may people over the edge. We know. We’ve been there. We have handled property damage claims resulting from hurricanes and hail storms for over 18 years assisting contractors, homeowners, and commercial clients.

We will take the time to review your policy and provide competent, cost-effective representation. You will never pay attorneys’ fees or costs if we cannot increase the amount of money you get from your claim. It’s a rare time to get a free lawyer!

We tailor our compensation based upon your situation. Our goal is to put the money in your pocket you need to fix your home or business.

Others have trusted us for years. We recover millions each year for our clients. Let us fight for you! Let us DEMAND YOUR RIGHTS!

GEAUX WITH RESULTS

Some Recent Hurricane Settlements Include:

$6,000,000 policy limits for a hotel (insurance initially offered $193,000)

$3,000,000 policy limits on a 4-story commercial building (Insurance attempted to settle the claim for $1M)

$2,400,000 commercial claim (Insurance attempted to deny the entire claim)

$1,360,000 commercial claim (Insurance offered $395,000 to client)

$750,000 commercial claim (Insurance offered $300,000 to client)

$558,000 residential claim (Insurance offered $132,000 to client)

$425,000 residential claim (Insurance offered $144,000 to client)